Idea of budgeting ahead for infrequent expenses. Savings Buckets… Rule # 2 – Embrace Your True Expenses Means to create a “Zero-Based Budget”, since your “To Beīudgeted” amount should equal ZERO after giving all dollars a job. And it isīuilt on the principle of “living on last month’s income”, which isĮxactly what I teach others to do in my Personal Finance 101 Guide.įollow the Four Rules Of Budgeting Rule # 1 – Give Every Dollar A Jobīe toward your expenses (bills, spending, debt, etc.). ONLY budget money you actually have, and to give every dollar a job. Zero-based budgeting software that gives you (almost) complete control of yourīudget, and is probably my favorite budgeting software on the market today.

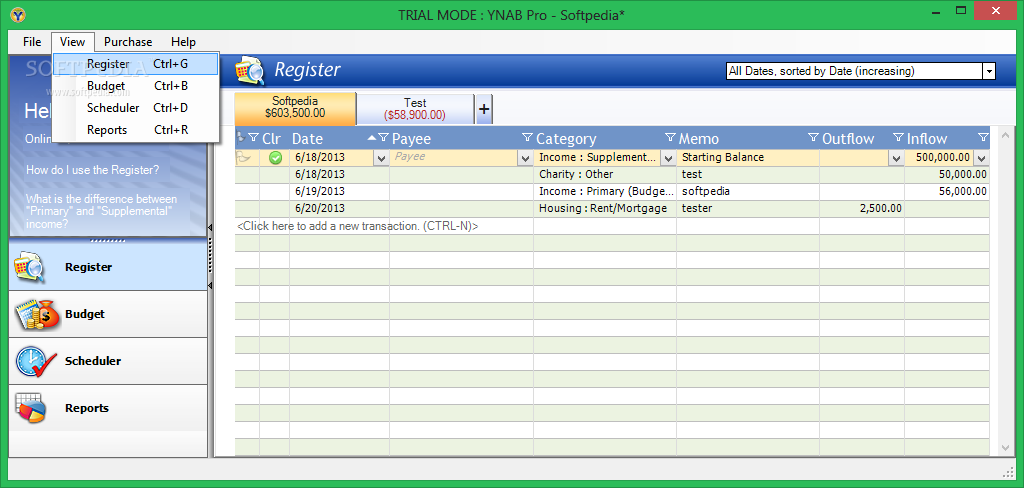

Thousands of people take back control of their money. Partnered with a developer and created the first stand-alone software versionĪnd based on their 4 Rules of Budgeting, has helped thousands and As you download/enter transactions, the amounts are deducted from their respective category balances.Brain-child of Jesse Mecham, a spreadsheet nerd (like myself) who built hisīudgeting spreadsheet in 2003, and started selling it. In either case, any inflow of money is tagged “to be budgeted” and from this sum you can allocate amounts to your spending and saving categories.

You can choose to direct import transactions from your bank or enter them manually. YNAB makes it easy to live by these rules with its category-based interface. It’s a lofty goal, but as YNAB says it will keep you “living far, far away from the financial edge.” Ideally, you should shoot to live this month on last month’s income. YNAB allows you to be nimble and easily move money from a budgeted category to cover unbudgeted spending and stay out of the red.Ĥ) Age your money-Timing your bills with your paychecks is about as easy as aligning the planets. YNAB lets you allocate every dollar in hand to specific spending and saving categories.ģ) Roll with the punches-No matter how well you plan, your budget will inevitably run head first into unforeseen expenses.

YNAB proposes you budget for these expenses monthly to even out your cash flow over the year and avoid taking big budget hits during certain months. What typically derails a budget are the less frequent ones, like annual insurance premiums and subscriptions, birthdays and holidays, and your kids’ seasonal sports fees. 2) Embrace your true expenses-It’s easy to see your monthly bills coming.

0 kommentar(er)

0 kommentar(er)